Reporting

Consolidated and

Comprehensive

Reports across all Asset Classes,

Vehicles and Direct Investments

A steady increase in regulatory requirements coupled with growth in data provisioning mean that comprehensive and detailed information on capital investments is required 24/7.

Using a stringent governance process, Universal Investment ensures data consistency for investors and provides support in the preparation of data.

Advantages

- Reporting across all asset classes and vehicles, including direct investments

- Stringent data governance process: data quality on all levels

- Compliant with regulatory requirements

- Independent performance analyses

- Ex-ante risk analyses with stress tests and risk profiles

- PowerPortal includes numerous reporting and analysis tools

PowerPortal

PowerPortal is the web-based technological platform for all types of reporting: flexible, modular reporting and analysis options, central access to tailored reports as well as more than 200 standard reports from a wide range of modules and asset classes, including real estate-specific stress tests. Around-the-clock reporting – including via a smartphone or tablet.

Rate your sustainability level

With the help of our independent ESG Reporting system you can rate the sustainability level of your fund portfolios. The ESG Reporting tool analyses a portfolio’s overall sustainability level as well as identifies any potential ESG weaknesses.

What is the advantage? You gain a comprehensive overview of the environmental, social and governance standards of your investments as well information on the key drivers behind your portfolio’s sustainability score.

MSCI®, a leading global research group, delivers the data required. The MSCI® database leverages its aggregated ESG scores of global investments (MSCI® is a registered trademark of MSCI Inc.).

Keep track of everything

Reporting across all asset classes and vehicles

The PowerPortal can provide consolidated reporting across all asset classes and vehicles, including direct investments. The reporting includes documents from investment committee meetings, updated standard reports on valuation dates, ad-hoc evaluation options and fact sheets.

Specialised reports are available for alternative investments and real estate (including real estate companies). In the case of private equity investments, Universal Investment can provide overviews on commitments and capital calls, internal rate of return (IRR) performance presentations and return multiples.

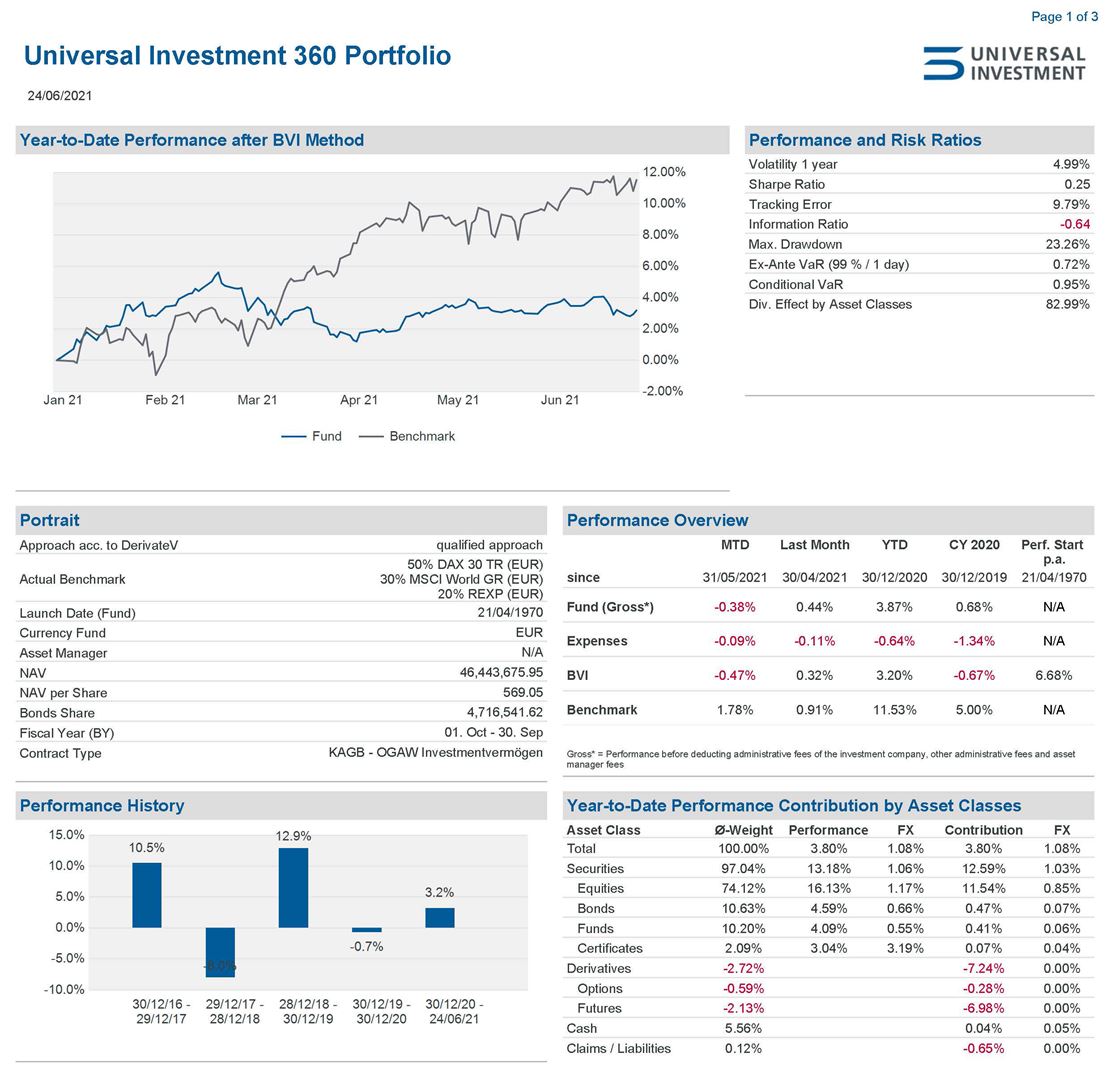

Measure performance and identify performance drivers

The analysis tool PerformanceAnalyse+ provides a detailed insight into a portfolio’s performance as well as independent information on the evaluation of the respective asset managers. Performance drivers can thus be identified and the investment decisions by asset managers that actively led to out- or under performance can be highlighted.

PerformanceAnalyse+ is modular and addresses the following frequently-asked questions regarding fund performance:

Performance contribution

- How much do the various asset classes, countries, sectors or individual positions contribute to portfolio performance?

Fixed-income contribution

- What impact did interest rate developments and credit rating changes have on performance? What proportion was attributable to coupons?

Performance attribution

- Which of the asset manager’s active allocation and stock selection decisions led to outperformance or underperformance relative to the benchmark?

Fixed-income attribution

- Was active duration management successful relative to the benchmark?

Reporting services

for Institutional Investors

Standardised or customised reporting? Universal Investment helps you meet supervisory and regulatory reporting requirements through its broad range of standardised or, upon request, customised reports. Our reports are subject to strict internal reviews and controls to ensure quality and regulatory standards are met.

For banks, we offer specific, standardised services that comply with the Capital Requirement Directive (CRD V) and the associated regulation (Capital Requirement Regulation, CRR).

The key services include:

- Solvency

- Large exposures and loans governance (GroMiKV)

- Credit Value Adjustments (CVA)

- Equity deduction items

For insurance companies and pension funds, reporting services comply with the relevant Solvency II and VAG regulations under the Solvency II Tripartite Template (TPT) and the VAG-BVI data sheet.

For investors with the relevant accounting background, our fund reporting complies with IFRS 9 accounting standards.

Identify risk factors

In order to more accurately assess the market risk of potential losses in the future, the risk-adjusted performance should take the ex-ante risk into account. With the introduction of the qualified approach in the German Derivatives Ordinance and in MaRisk, the measurement of potential losses using quantitative methods has been included in supervisory law. Universal Investment is therefore expanding this regulatory framework and through RisikoAnalyse+, it offers among other services, the following components to help assess market risk.

Components

- Ex-ante risk indicators for addressing such questions as

- How high is my loss potential with a predetermined probability and holding period?

- How high is my loss potential in extreme market phases that are highly unlikely to occur?

- Risk allocation comparison to asset allocation

- Diversification according to risk types and asset classes

- Risk contributions of individual positions to the portfolio’s overall risk

- Individual stress tests and scenario analyses

RisikoAnalyse+ identifies which asset classes or risk factors (such as interest rates or currencies) contribute the most to measured risk. Analogous to the top performers, the top risk contributors can also be identified.

Flexible stress test options, which are also applied in RisikoAnalyse+, are offered to assess how a portfolio reacts to extreme market changes. In so doing, possible effects from political shifts or market events, such as interest rate changes and stock market crises, can be analysed. Scenario analyses answer the standard “What would happen if…?” questions and provide investors with a clearer assessment of their portfolio’s risk content.

Compile focused and concise standard reports

Senior management reporting facilitates the focused and concise presentation of key information from the multitude of standard reports stored in the PowerPortal, thereby ensuring “everything-at-a-glance” reporting.

Contact

Marcus Kuntz

Area Head Sales & Fund Distribution