ESG Reporting

ESG Reporting

opens up New Opportunities

Environment. Society. Performance

Thanks to Universal Investment’s independent ESG Reporting system, you can rate the sustainability of your fund portfolios. Our reporting model uses reliable indicators for ESG-based investment strategies.

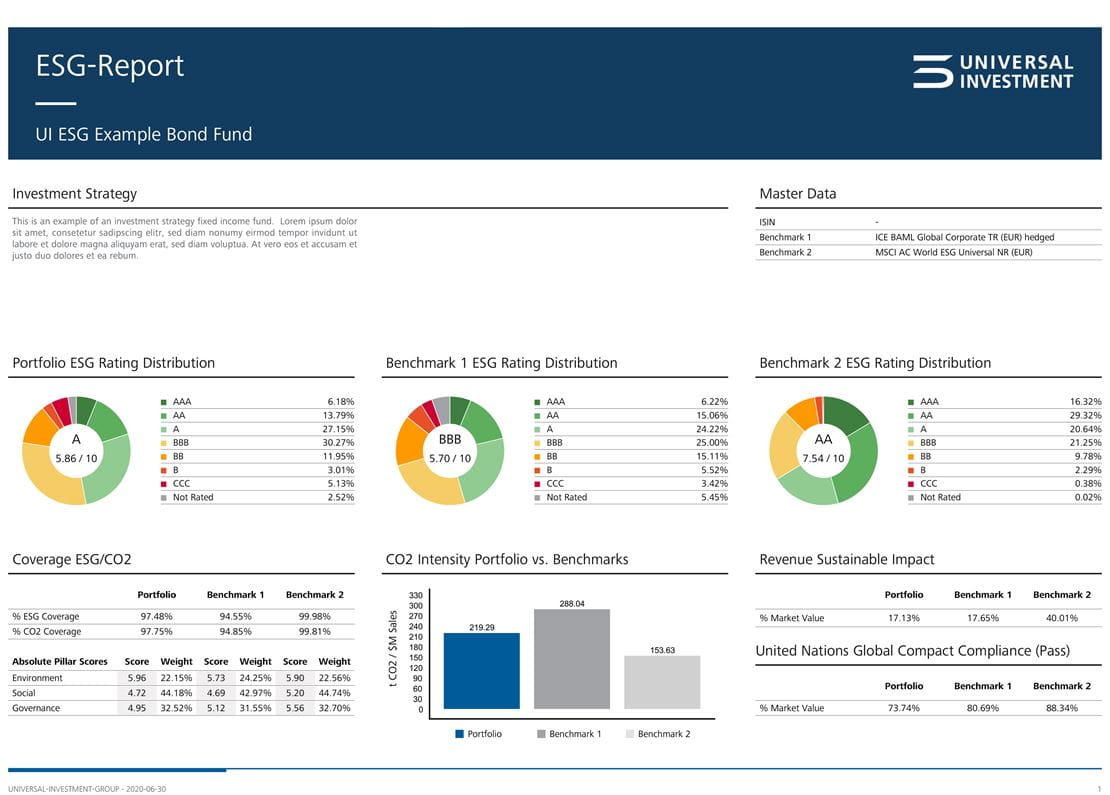

The ESG Reporting tool analyses a portfolio’s overall level of sustainability and identifies any potential ESG weaknesses. What is your advantage? You gain a holistic overview of the environmental, social and governance standards of your investments as well details of the key drivers behind your portfolio’s sustainability score. MSCI®, a leading global research group, delivers the data required. The MSCI® database leverages its aggregated ESG scores of global investments (MSCI® is a registered trademark of MSCI Inc.).

Agenda 2030

Balancing financial and ESG compliance

Since the ratification of the Paris climate goals for 2030, sustainable returns require redirected capital flows. ESG Reporting covers the traditional presentation of allocations and monitors the overall context of the portfolio. The goal is to balance the need for returns and ESG compliance. Universal Investment’s ESG Reporting system provides an overview of a fund’s key sustainability criteria and offers a comparison with ESG benchmarks and market benchmarks.

Reliability and transparency

Sustainability in figures: portfolios and ESG scores

How does my fund portfolio stand up in terms of ESG criteria as well as environment, social and governance standards? Which aspect of sustainability contributes most to my overall ESG score? Comprehensive ESG Reporting is delivered punctually, reliably and transparently.

Customised reporting in the required depth of detail

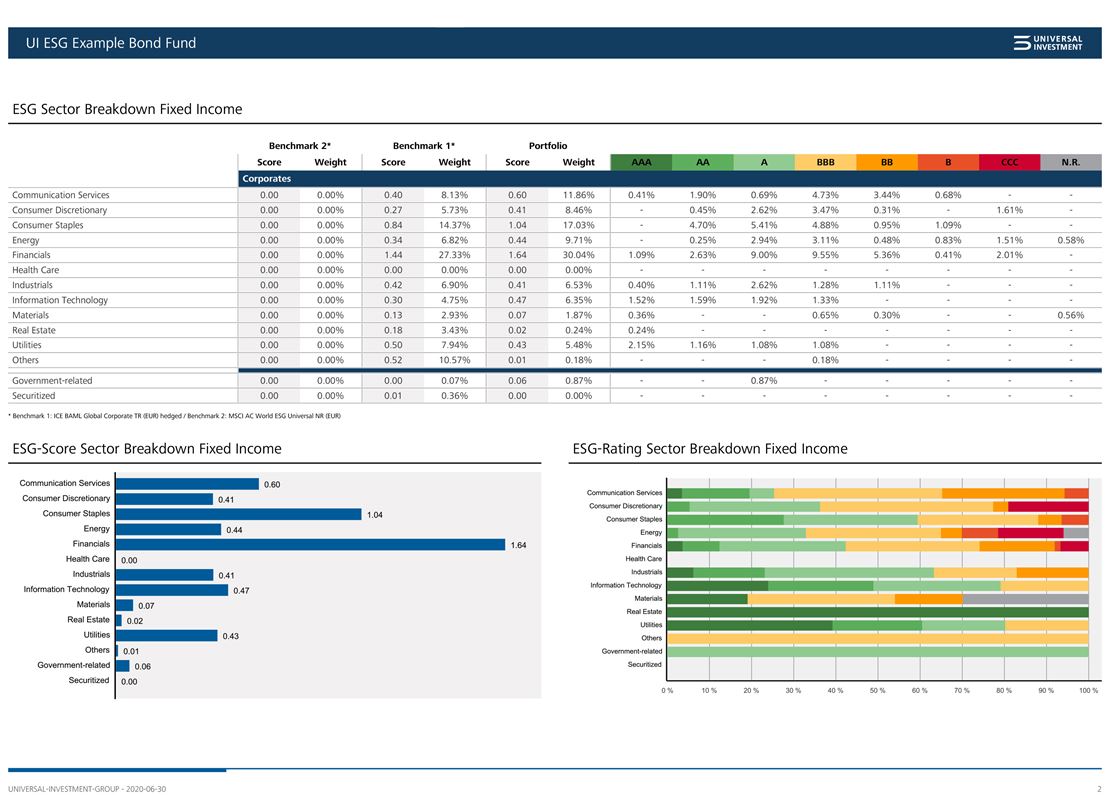

Whether you want to highlight your carbon footprint, your attribution analysis, your ESG score or provide details on sectors and individual companies – our ESG Reporting tool supplies the visual format you require. A separate evaluation, including an aggregation of all individual fund assets, as well as chosen benchmarks, provide a clear overview of your portfolio that includes your overall ESG score and details of the depth of coverage.

ESG controversies require

a watchful eye

Top 10 ESG positions and the top 10 flops

Universal Investment adopts a convincing top-down approach for its ESG Reporting: after compiling general information it then analyses which individual portfolio positions are performing particularly well (the top 10) or particularly badly (the flop 10). Business involvement evaluations and impact monitoring indicate the proportion of controversial industries, countries and practices represented in the portfolio. A carbon footprint calculation can also be provided for each individual industry.

Relevant benchmarks and ESG controversies

ESG Reporting specialists at Universal Investment are on hand to help you find the right benchmarks for your ESG Reporting set-up. The business involvement analysis included in our services is underpinned by data from MSCI®. Exclusion criteria can therefore be established for companies that generate revenues from controversial business areas, violate ESG standards and regulation or are subject to sanctions.

ESG Reporting

- Basis for the implementation of an ESG-based investment strategy

- Reliable data from MSCI®

- Depth of detail can be tailored to your requirements

- Support in the definition of benchmarks and the individual ESG setup

- Reporting tool with modular features tailored to individual needs

- Top 10 ESG positions and top 10 flops

Optimise your potential

Carbon footprint

In addition to providing ESG analyses, Universal Investment's reporting tool can also display a portfolio's carbon footprint. It highlights the CO2 emissions of individual positions, identifies possible carbon risks and analyses efficiency, risk exposure and positive asset allocation with regards to clean technology.

-

Universal Investment – Sustainability

Corporate sustainability is part of our company's DNA. On a strategic level, we have incorporated sustainability into our corporate vision, while on the operational level, our ESG office is responsible for the implementation of our goals.Read more

Contact

Marcus Kuntz

Area Head Sales & Fund Distribution