Transition Management

Ensure Transparency

Maintain Control

Mitigate Costs

Transition Management

In periods of weak earnings it is all the more important to avoid unnecessary costs and risks. Major portfolio restructurings, such as those that are typically required when switching asset managers, are particularly risky. Management of risk and performance may be hampered during the transition phase and costs may mount as a result.

Of these costs, only about 20% on average are explicit, while 80% are implied and difficult for investors to determine. This is where professional transition management comes into play: risk management and transparency can be guaranteed throughout the transition process and up to 60% of total costs saved.

Investors have repeatedly placed their trust in us, with 350 transitions totaling 117.9 billion euros. Clients can rely on first-class support in their transition from start to finish as well as seamless combination with our master KVG services (As of December 2023).

80%

60%

350

Investors can benefit from transition management in the following scenarios

- A termination of an asset manager or consultant either with or without a successor (interim management)

- An asset manager switch in one or more segments

- The launch or restructuring of a new segment with cash or existing assets

- The liquidation of a fund or segment after a termination of an asset manager or consultant

- Allocation adjustments or a new strategic asset allocation (SAA) within master funds

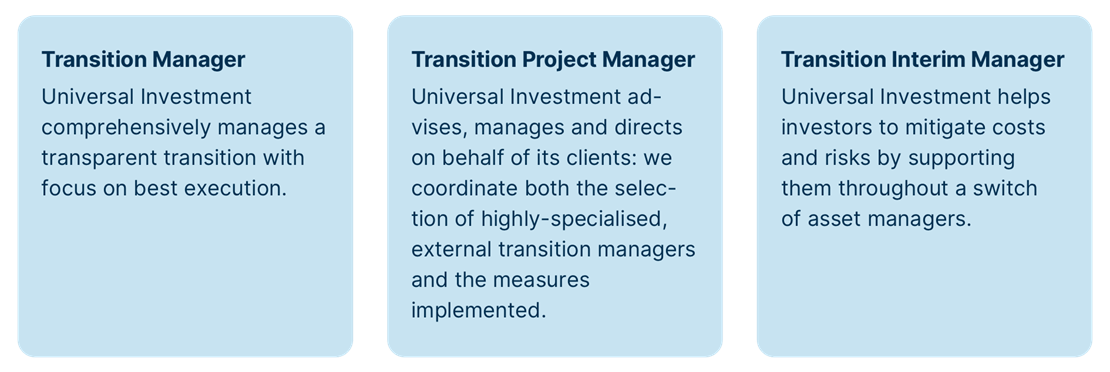

The scope of services and our role as transition manager

The scope and type of implemented transition services are tailored to the investor’s portfolio and to their specific requirements. The range of our services and roles vary as follows:

Analyse tasks, plan strategies,

evaluate performance

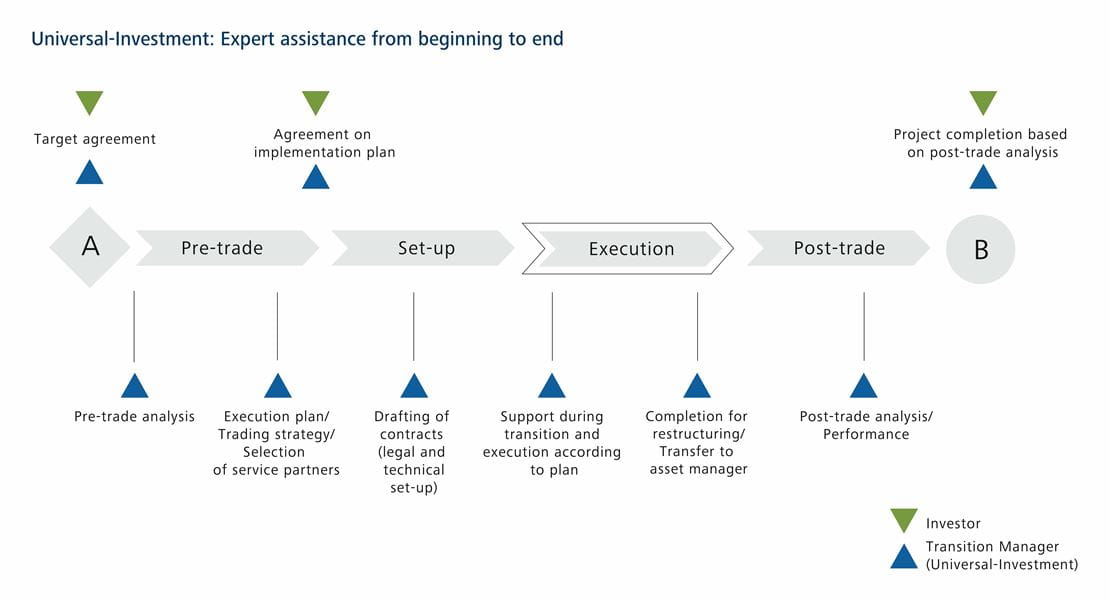

An unsupervised transition from an initial portfolio (A) to a target portfolio (B) carries incalculable risks and costs. Only structured and comprehensive support during the entire transition can guarantee transparency, cost mitigation and ultimately performance throughout the duration of the transactions involved.

Universal Investment's modular concepts are designed to meet the uniquely-complex requirements of each transition project. If necessary, we select and work with specialised transition managers externally. Whatever the case, Universal Investment's experts are on hand from the start of the transition to the finish.

Source: Portfolio Management Universal-Investment-Luxembourg S.A., Branch Frankfurt am Main

Source: Portfolio Management Universal-Investment-Luxembourg S.A., Branch Frankfurt am Main

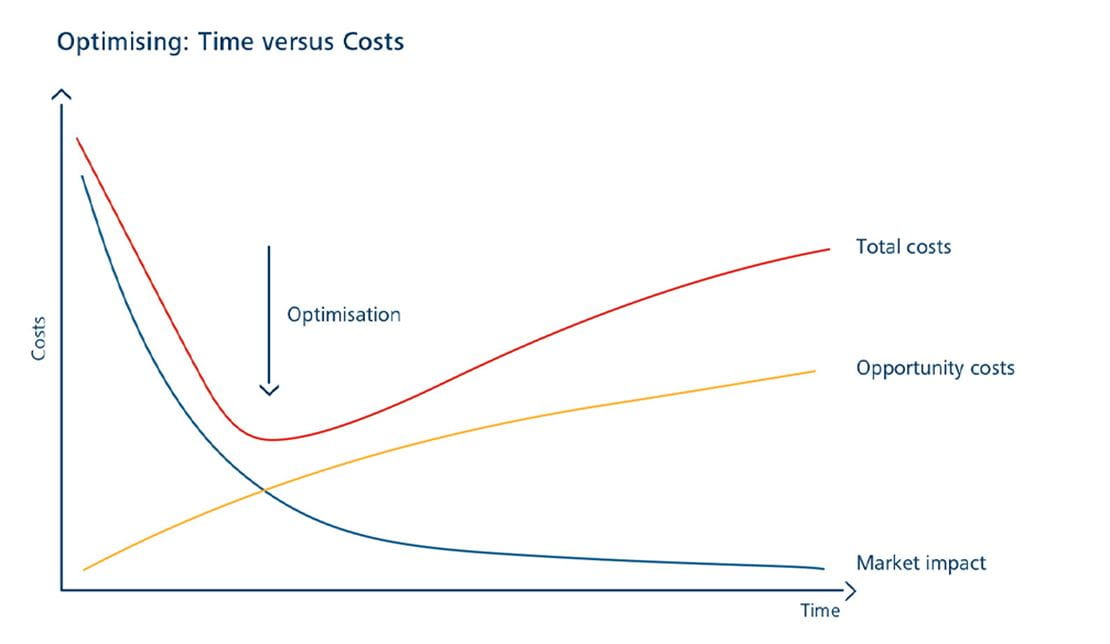

Analyse costs and risks

The explicit costs of a transition, such as broker and management fees, can be documented. Implicit costs, such as market impact costs, are more difficult to estimate. A pre-trade analysis identifies these costs and their individual magnitude. Implied costs are put in relation to the performance risk in the form of opportunity costs.

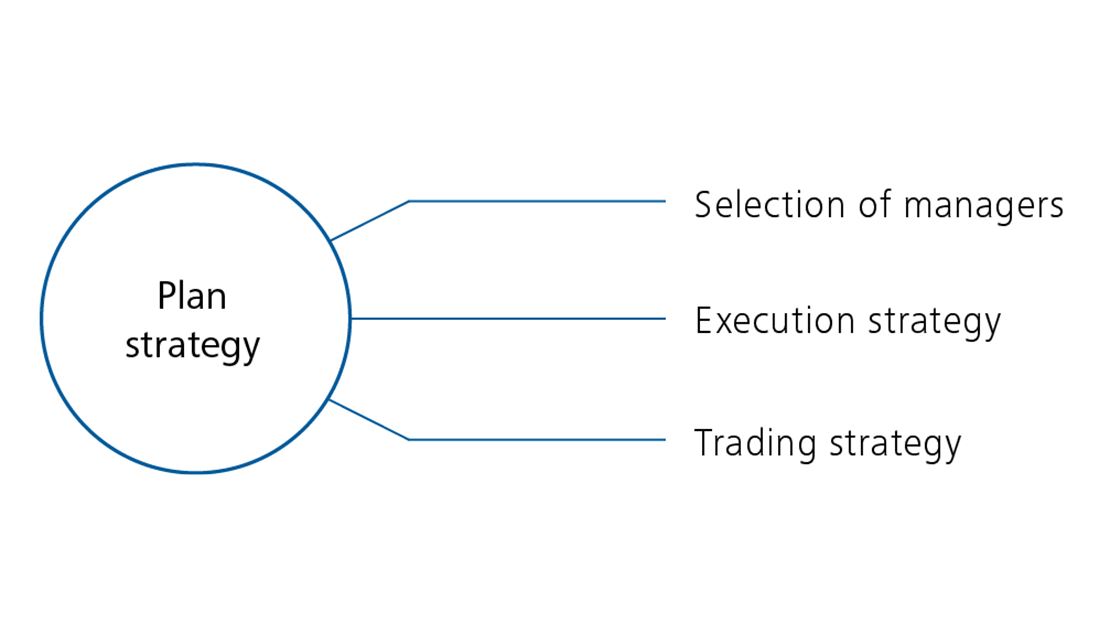

Plan strategy

Universal Investment provides investors with a consolidated pre-trade analyses, the suitable transition managers to meet investors’ specific requirements, as well as a choice of service partners for the project. We steer and control the execution.

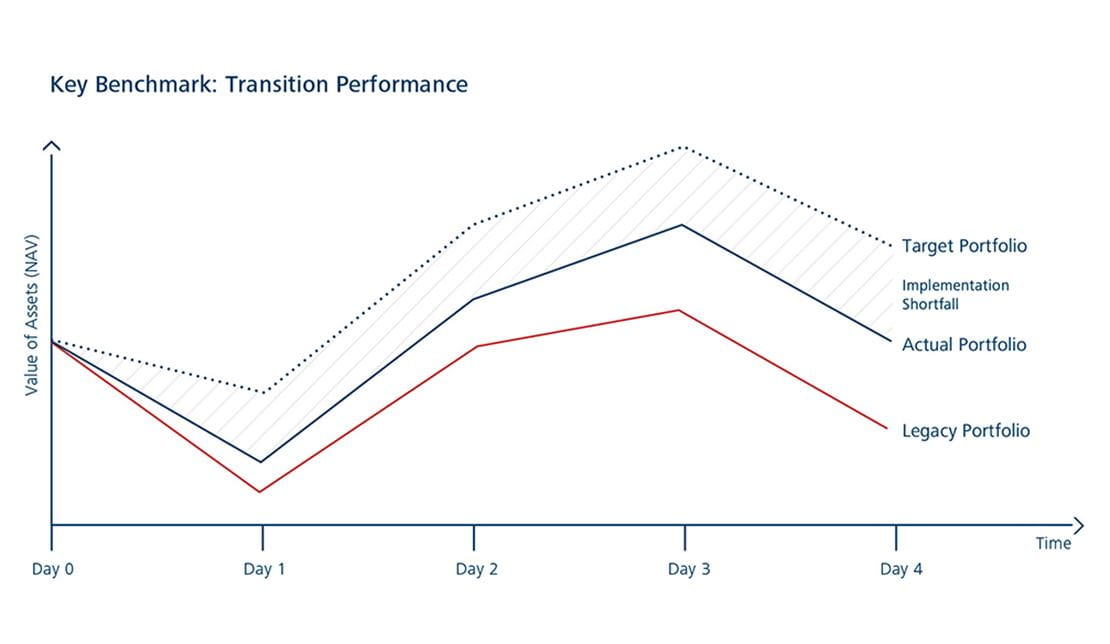

Evaluate performance

The implementation shortfall is calculated in the pre- and post-trade analysis and in the performance review. This tried-and-tested model can be used to calculate the total costs (explicit and implicit) of a transition.

Contact

Marcus Kuntz

Area Head Sales & Fund Distribution