Outsourcing and International Expansion

– the best of both worlds

Faced with intensifying commercial pressures, including regulatory headwinds and eroding margins, boutique asset managers are adapting their strategic models. The 2025 Boutique Asset Management Survey reveals how firms are embracing operational efficiency and international growth to remain competitive – providing unique insights into the direction of the industry.

Key findings

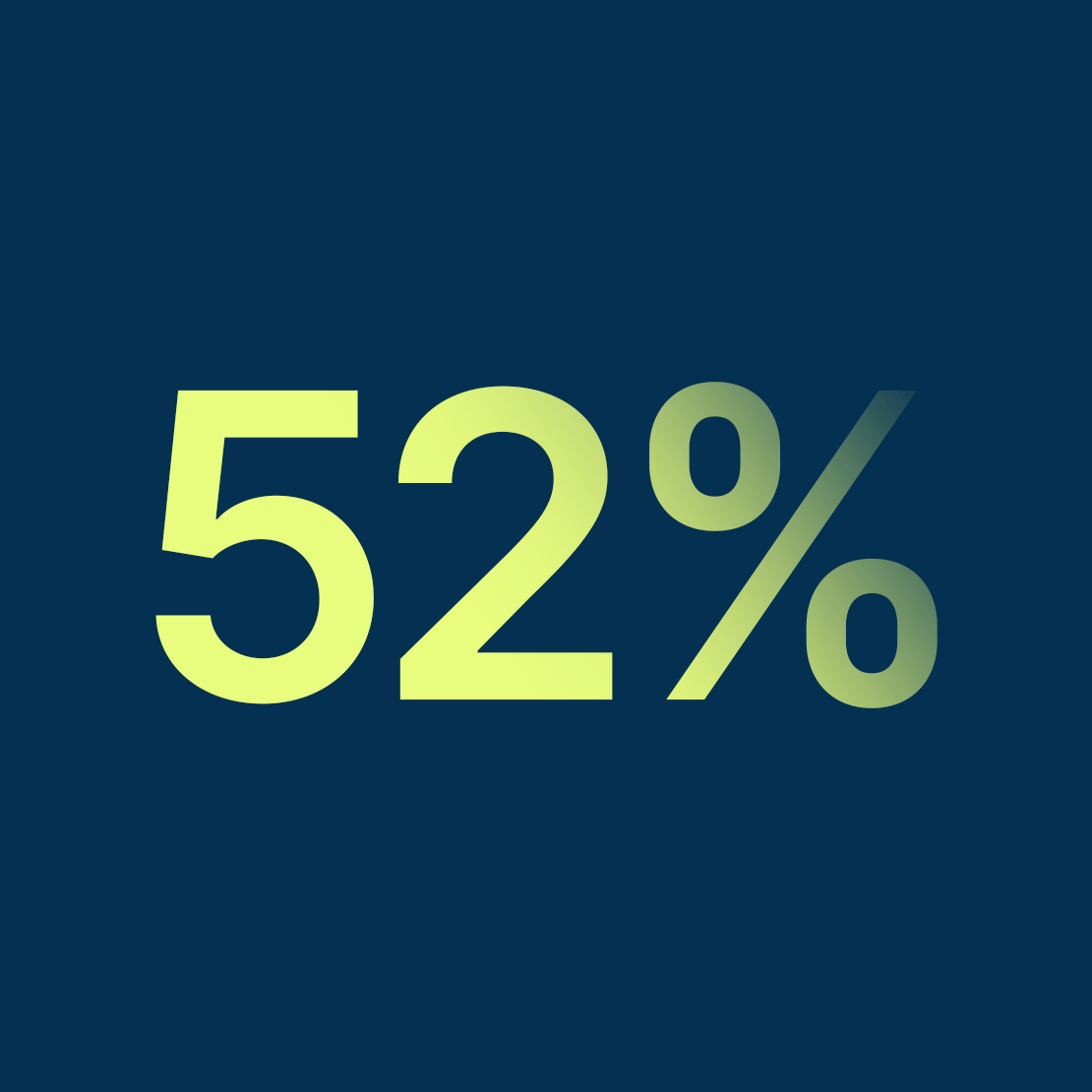

of boutiques plan to outsource business functions within 12-24 months

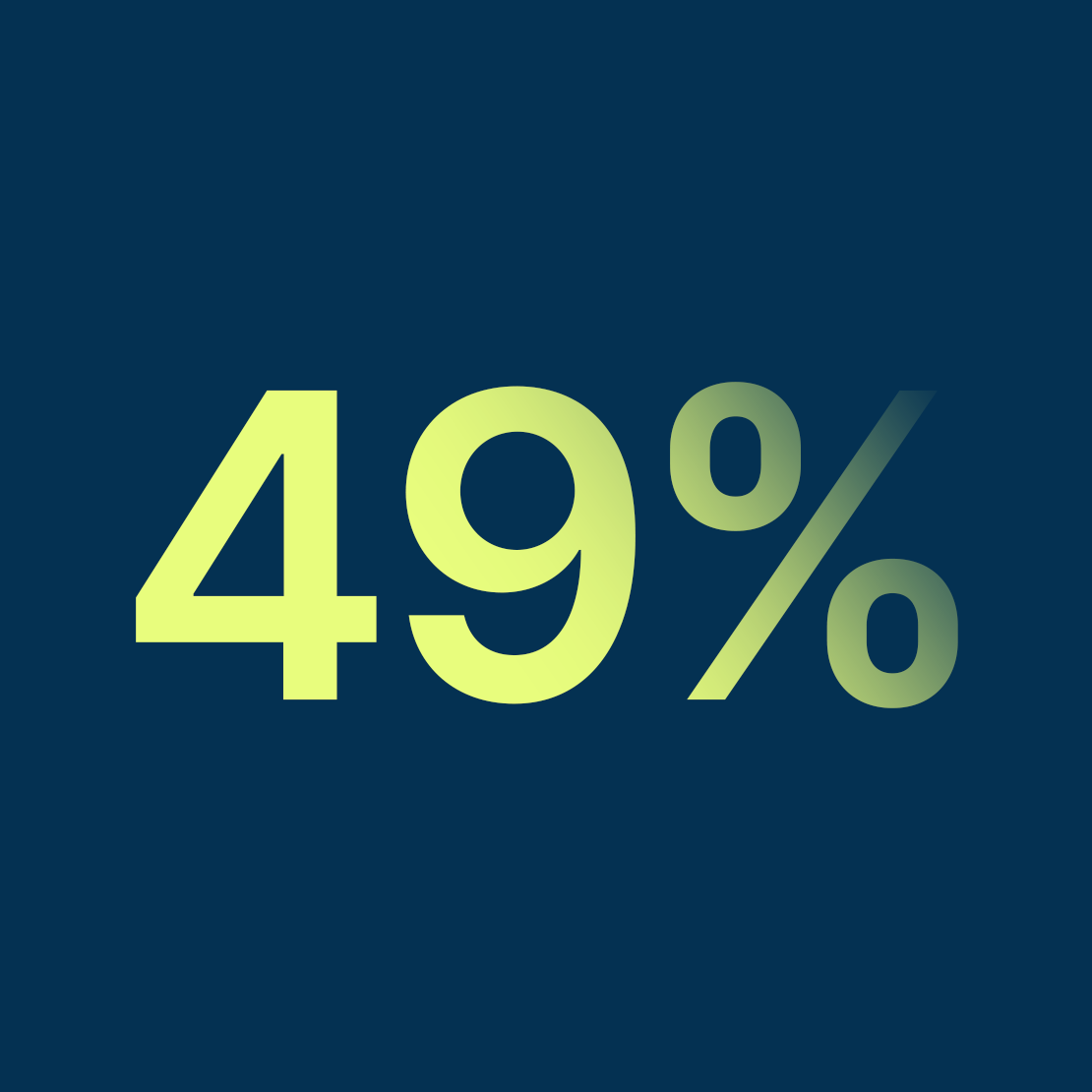

plan international expansion over the period

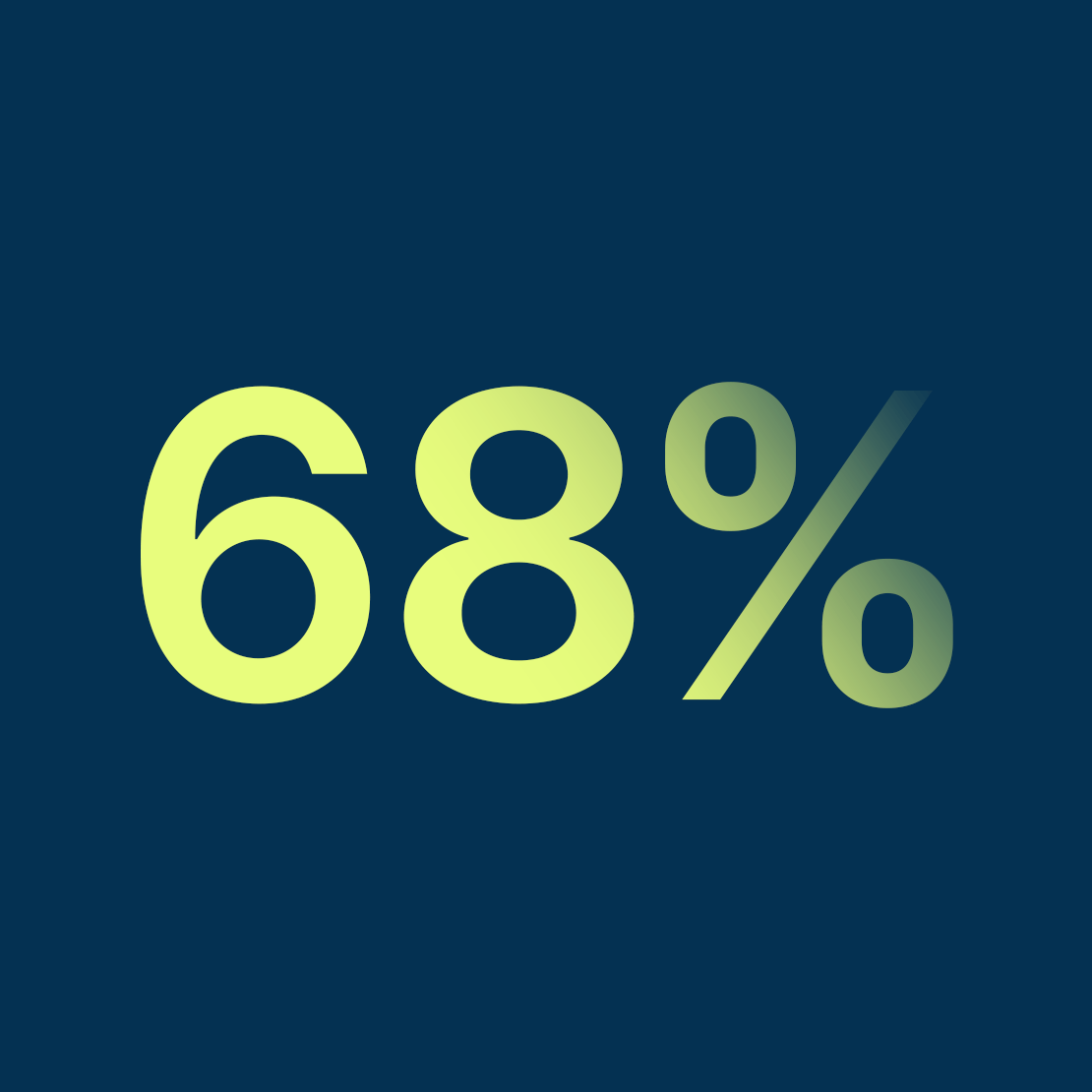

intend to outsource ManCo services or fund administration

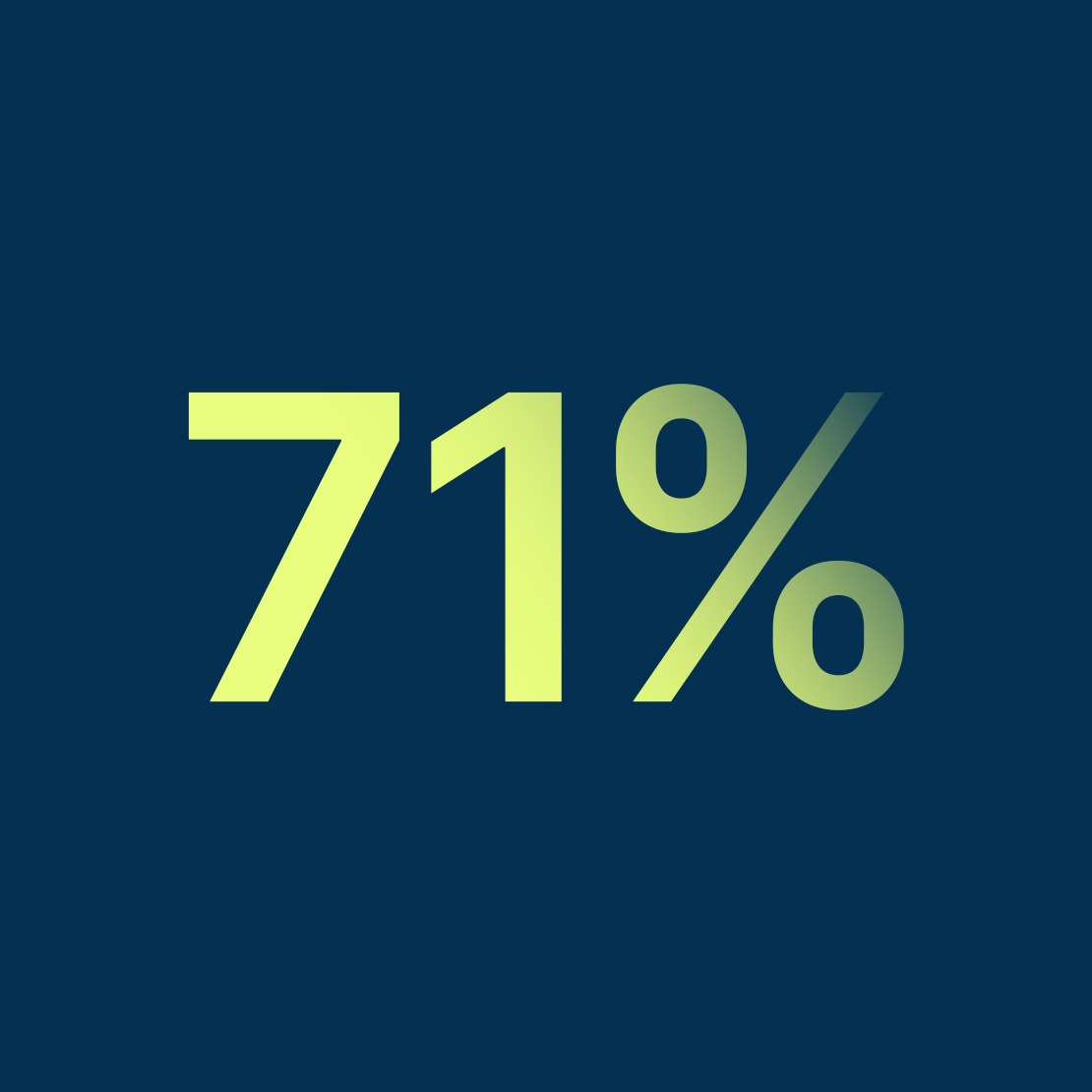

target German-speaking Europe for international expansion

In a market defined by complexity,

boutiques aren’t standing still.

The latest iteration of our annual, international Boutique Asset Management Survey uncovers a sector in motion. Firms are scaling smarter, rethinking operations, and looking internationally for growth opportunities.

Drivers for Change:

Commercial & Regulatory Pressures

- Regulation tops the list of concerns, named by 71% globally, with that number rising to as many as 86% in Central Europe

- Competition and margin erosion are a concern for 41%, while 39% point to differentiation challenges in an increasingly crowded sector

- Growing demand for passive products (40%) is also increasingly seen as a threat, particularly in the UK and Europe

As geopolitical tensions have increased and the direction of markets has become less certain, many organisations are seeking to streamline operations through outsourcing non-core functions, while others are taking bold steps to pursue growth in new and existing markets.

We can help asset managers capitalise on international opportunities – with all fund services in one place.

As a Super ManCo and fund services platform with over 50 years of experience, Universal Investment is uniquely equipped to support boutique firms on both fronts:

- From ManCo and fund administration to front-/middle-office and distribution services

- Cross-border functions through UCITS, AIFs, and international structuring expertise

Our plug-and-play model delivers scale, regulatory expertise, and robust distribution connectivity - so you can focus on what matters most: investment performance.

ManCo Services

- Advice on all aspects of administration as well as on fund conception/restructuring, transition and additional services

Fund distribution

- Fund accounting, fund valuation and calculation of unit prices

- Calculation, determination and processing of distributions/reinvestments

Fund marketing

- Project management for fund launch, transfer and restructuring, including establishing time schedule/drawing up contracts/monitoring fund project

- Publication and reporting obligations

- Organisation of investment committee meetings

Administration services

- Monitoring of investment limits and guidelines

- Monitoring of and coordination with custodians

- Support for and monitoring of asset managers (price control)

Contact