News

Alternative Investments and ESG

Date:

22. October 2020

On the way to becoming the normality

Dr. Sofia Harrschar, Member of the Board, Executive Director, Head of Alternative Investments, Universal-Investment

Dr. Sofia Harrschar, Member of the Board, Executive Director, Head of Alternative Investments, Universal-Investment  Robert Bluhm, Sustainability Officer, Head of Securities Product Management

Robert Bluhm, Sustainability Officer, Head of Securities Product Management From extreme to normal: tropical temperatures and severe drought for the third summer in a row now have once again provided us with a sharp reminder that climate change is very much real. There has been a shift in public awareness, and sustainable investments are becoming increasingly important. This can be clearly seen in the case of liquid investments. In the second quarter of 2020, inflows into European sustainable funds continued to gain momentum, attracting almost a third of overall European fund flows and accounting for 54.6 billion euros of a total of 165 billion euros.1

1 Morningstar, 31.07.2020

Alternative Investments: sustainability ia a fundamental theme and growing trend

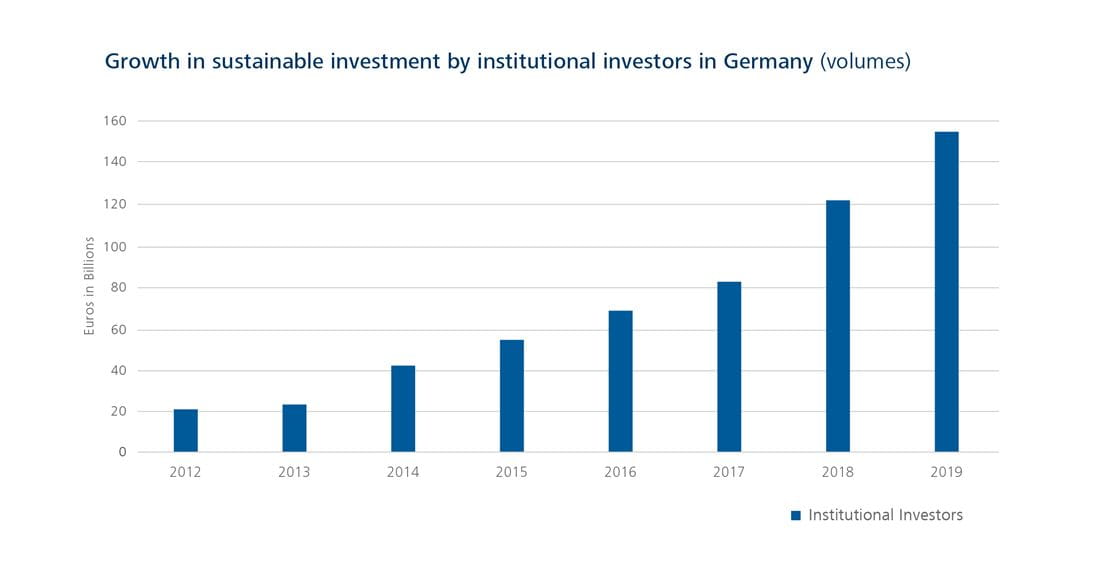

Sustainability is also playing an increasingly important role for institutional investors. Investments in sustainable funds and mandates by institutional investors in Germany grew 48 percent in 2018 and a further 27 percent in 2019, according to the Forum Nachhaltige Geldanlagen e. V. (the German, Austrian, Liechtenstein and Swiss sustainable investment forum).

Several alternative investments have classical sustainability features, including those in infrastructure for local- and long-distance public transport that reduce CO2 emissions or in projects in the renewables sector such as those in photovoltaics or wind energy.

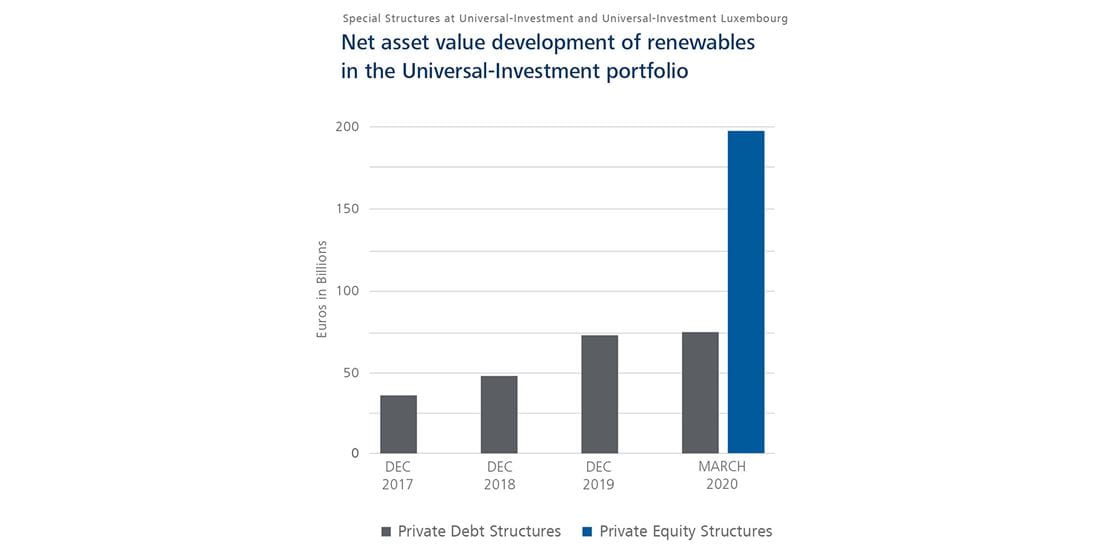

Universal Investment figures also reflect the growth in the renewable energy sector; renewables are among the alternative asset classes showing strong growth, albeit at a low level in absolute terms for now. Capital invested in private debt structures more than doubled to 75.5 million euros between the end of 2017 and March 2020, while capital invested in private equity structures increased to 194.4 million euros from zero.

By no means, however, do all alternative investments meet ESG criteria at first glance. What is more, ESG principles are not yet firmly established in the industry. A survey onf ESG investing by the German association for alternative investments BAI, published in August 2019, revealed that investors were still extremely wary: 55 per cent of investors surveyed had not yet had any experience in with sustainable investments. Fifty-seven per cent of respondents saw the definition of their own individual ESG strategy as the biggest challenge. Furthermore, half of those surveyed expressed uncertainty regarding future legal and regulatory requirements.2

2 BAI Alternative Investors Survey 2019

ESG compliance creates opportunities

ESG criteria are likely to become increasingly important in the future as a fixed measure for institutional investors and asset managers. The goal of maintaining a strong balance sheet that follows ESG principles is not solely about avoiding potential risks to the portfolio’s reputation, however. It can also be a decisive factor for companies when raising equity and debt financing. A strong ESG balance sheet can therefore have a positive effect on a company's strategic options and its business success.

ESG-reporting is already helping institutional investors analyse their liquid portfolios in traditional asset classes using sustainability principles. Progress is not yet as advanced, however, in the field of illiquid asset classes, and only tentative steps have been made in the area of systematic ESG reporting for alternatives. The reasons for this are the specific challenges the sector faces, including measurement problems and the difficulty of obtaining reliable data.

Some cases are relatively straightforward, for example those that exclude certain lenders in the private debt sector (e.g. arms manufacturers) or select target companies in the private equity sector on the basis of positive and exclusion criteria. It is, however, more complex as a rule: how exactly can risks – at the manager, portfolio and asset level – be assessed and processed? What significance do they have for regulatory reporting? How can I determine a private equity company’s "impact"? These and other such questions need to be answered.

Support during the integration of sustainability factors

Alternative investments are likely to play a significant role in helping create a sustainable economy. The climate goals of the Paris accord can only be achieved through substantial investments - investments that cannot be financed by the public sector alone. By investing sizeable sums into infrastructure and renewables, the alternative investment sector can make a significant contribution.

Alternative investments are complex investments both in terms of their structure and administration. It makes sense that potential investors and fund initiators – regardless of whether they wish to adhere to ESG principles or not – work with an experienced structuring partner and provider, including in the tailored set-up and structuring of alternatives or in services ranging from administration to reporting.

In order to help investors implement ESG principles, the partner should also lead the way in sustainability advice by:

- supporting customers and business partners in incorporating sustainability principles in their investments, as well as in complying with regulatory requirements and standards,

- collaborating on the development of new, more sustainable products and services,

- actively participating in the shaping of regulatory requirements and standards, including in the field of alternatives, for example through the BAI or other associations

- providing customers and business partners with expertise on sustainability issues

- driving market change through comprehensive exchange and cooperation on sustainability issues.