News

Transition Management – more important today than ever

Date:

13. May 2024

- Portfolio Management

Restructuring portfolios can be challenging. In addition to potential performance drops and cost risks, a lack of transparency plays a significant role. With the support of a professional transition management team, transparency and risk control can be ensured at every stage of the transition process.

Carrying out a major portfolio restructuring is like changing the captain on the high seas. Would you let go of the wheel before the new helmsman takes over? Hardly. And yet this can happen in a portfolio restructuring if you, for example, switch asset managers without the help of professional transition management. From selling assets from the original portfolio to achieving desired market exposure by the new asset manager in the target portfolio, a control vacuum can occur. Possible consequences include an undetected rise in costs or performance losses. Typically, only about 20 percent of the total restructuring costs are attributable to explicit costs such as broker fees and financial transaction taxes. By contrast, 80 percent are implicit costs that are difficult for investors to determine.

Even seemingly “boring” government bonds carry risks

Following Russia's attack on Ukraine, and particularly in recent months, the market has been highly volatile - and not only in stocks. Bonds have been affected too: the “Bund Future March 2024”, for example, experienced a real rollercoaster ride from November 2023 to January 2024. Within a few weeks, it climbed from 130 in November to 138.7 by the end of December, before dropping steeply to 133.6 in January. Even seemingly “boring” government bonds now carry considerably higher restructuring risks than in the past. The climate has also harshened for currencies: with the volatility in the interest rate markets, even the risks surrounding major global currencies have increased. Short-term fluctuations of sometimes more than one cent in the USD/EUR exchange rate within a trading day can significantly increase the cost of uncoordinated restructuring.

Amid increased volatility and uncertainty in equities, bonds, and currencies, the risks associated with virtually any type of restructuring have significantly increased, whether in an equity, bond, or multi-asset portfolio.

Even in relatively calm market phases, professional transition management can make a decisive contribution to ensuring the long-term profitability of portfolios.

Transition Management: controlling performance and costs

There are different motives for restructuring a portfolio. These typically include adapting to regulatory requirements, changing investor risk profiles, and rebalancing asset allocations after crises or strong rallies in individual asset classes.

Typical situations for using professional transition management

- Allocation changes within a master fund or between different master funds

- New strategic asset allocation (SAA)

- Changes involving appointed asset managers, such as replacements or terminations, as well as segment mandates and liquidations

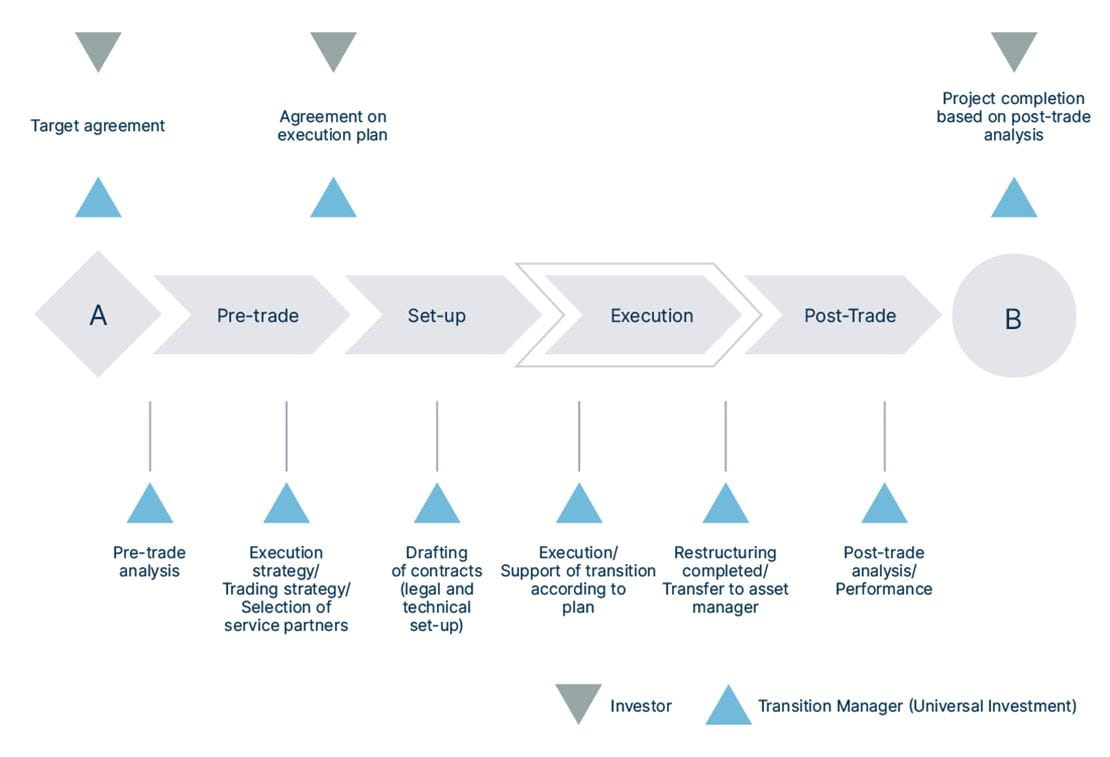

Each fundamental change to the strategic asset allocation involves a transition phase from the existing portfolio (A) to the desired new structure (B). During this phase, transition management assists in maintaining control at every stage of the transition process, ensuring transparency, and minimising total costs. Typically, the total costs can be reduced by an average of 60 percent, even when considering the fee for the professional transition manager.

Optimisation: time versus costs

Spread or market impact costs are the typical counterparts to opportunity costs in the restructuring process. The longer it takes to achieve market exposure in line with the specifications of the new portfolio (B), the higher the opportunity costs may rise, as potential price increases in the portfolio are not reflected in the interim period. Conversely, acting too quickly can lead to unnecessarily high market impact costs - especially for transactions in less liquid markets. Every execution strategy for a transition thus aims to optimise in terms of time and costs.

Optimisation: time versus costs

Optimisation: time versus costs According to the experience of the transition managers at Universal Investment, the factor of time can play a crucial role today. For example, due to the sharp rise in interest rates at the short end of the yield curve since the start of the war in Ukraine and the resulting inversion, portfolios with short duration or money market securities have again become attractive for many investors. Differences in liquidity, particularly when selling longer-term bonds and buying bonds in the money market segment, lead to fundamentally different execution speeds. This is considered in a planned transition management process with cash-neutral trading, where the less liquid side sets the pace.

Transition Management: success is measurable

By calculating the implementation shortfall, which is conducted in the pre-/post-trade analysis and performance review, the actual total costs of a transition can be transparently presented. This method includes all explicit and implicit costs of a restructuring. To this end, it compares the performance of the target portfolio (B) (hypothetically starting with the end-of-day prices at the beginning of the transition and excluding the transition costs) with that of the actual portfolio during the transition phase. The aim of transition management is to minimise this performance difference. Hedging, crossing, and overlay techniques are also used for this purpose.

Success measurement for the transition: implementation shortfall

Success measurement for the transition: implementation shortfall Transition management: as early and comprehensively as possible, and with an experienced manager

Two factors are crucial for the success of a restructuring: (1) involving professional transition management as early as possible. (2) selecting a service partner for transition management with in-depth expertise, long-standing experience, and the best interfaces (in terms of a ManCo). The partner should also be capable of overseeing the transition from start to finish and selecting from a broad range of modular services those that are essential for the success of the specific restructuring project.

Transition Management with Universal Investment: from start to finish

Transition Management with Universal Investment: from start to finish Our team has over 20 years of experience and expertise in transition management. We have successfully managed over 350 transitions with a total transition volume of around 117.9 billion euros, demonstrating the trust that investors place in Universal Investment and our transition management. Find out more about our services and gain insights into fascinating case studies. (As of December 2023)