News

Fresh momentum in bonds

Date:

05. July 2023

A new era has dawned: last year’s interest rate hikes spelled the end of the prolonged phase of low interest rates. The ECB’s move to underpin risk assets through its Forward Guidance and prospect of sustainable zero interest rates are now all but a memory. Bonds are once again catching the attention of institutional investors and fund initiators. Short-term bonds currently offer particularly attractive yields. Euro Government Bills can reduce counterparty-risks. This article outlines the options that have re-surfaced in the bond sector after the lengthy dry spell, as well as shows how effective they can prove in various market scenarios.

The share of bonds in strategic asset allocations has been declining for several years now. This is partly due to the strong performance of equities as well as to low or negative yields. Since the first quarter of this year, there have been increasing signs that the trend might change. Even during turbulent phases, most bondholders refrained from selling. Following price markdowns, they are now expecting solid returns by the maturity of the bonds. Others are starting to recognise the potential bonds hold for a portfolio.

360-degree analysis:

Bonds spark institutional investors’ interest

Jochen Meyers, Area Head Relationship Management Institutional Investors, Universal Investment

Jochen Meyers, Area Head Relationship Management Institutional Investors, Universal Investment

We’re observing a renewed interest among our clients' mandates in apportioning a greater share of bonds in their strategic asset allocations

Inflation, interest rates, the economy - a tricky three-way relationship

Investors are currently faced with considerable uncertainty. The Fed and the ECB were slow to move on increasing interest rates last year, while the war in Ukraine and ongoing supply chain disruptions shook the markets and ultimately led to lacklustre performance across nearly all major asset classes. It was not until the third quarter of 2022 that the markets settled into the new regime and adjusted their expectations. The measures implemented by the central banks seemingly had their intended effect, with a slight drop in inflation and surprisingly robust economy. This set a positive tone for the start of 2023 for equity and bond investors.

But what does the future hold? Has inflation really eased?

Despite a decrease in the consumer price index compared to last year, the core inflation, adjusted for volatile elements like energy and food, remains stubborn. This is carefully monitored by financial experts and for the decision-making bodies within the central banks, core inflation is the more important parameter.

Wolfgang Zecha, Senior Portfolio Manager, Universal Investment Luxembourg

Wolfgang Zecha, Senior Portfolio Manager, Universal Investment Luxembourg

Global analysts take the announcements of central banks seriously and do not expect rapid interest rate cuts

Wolfgang Zecha, Senior Portfolio Manager at Universal Investment Luxembourg, is skilled at gauging the average forecasts of leading global analysts on how central banks’ will adjust their interest rate policies to inflationary developments. He uses the UI analyst consensus, a method employed by the experts at Universal Investment to identify external key interest rate expectations in the US and the Eurozone on a monthly basis. The analysis takes into account the forecasts for the remainder of the current year and the subsequent year, presently 2024, along with analysts’ expectations when interest rates will peak. In the analysis conducted in May 2023, the ECB key interest rate was expected to reach a peak of 3.7 percent to 3.8 percent over the course of this year. It is expected that the key interest rate will stay close to this level until the end of 2023. Looking ahead to the end of 2024, analysts still project the key interest rate to be slightly above three percent. They therefore expect interest rates to be higher than in February 2023. Accordingly, analysts’ outlook is notably more pessimistic than that of bond market investors who have already factored in a swifter decline in interest rates, thus estimating the impact of prolonged high interest rates on the economy to be less burdensome.

A conundrum is arising between analysts' expectations - which are in line with central banks’ outlooks - and market opinion. The reactions of the equity and bond markets will vary based on the prevailing perspective at any given time. This discrepancy is likely to cause volatility for the foreseeable future, including in the bond markets. Although bond yields have rebounded to attractive levels after interest rate hikes, they remain subject to significant volatility.

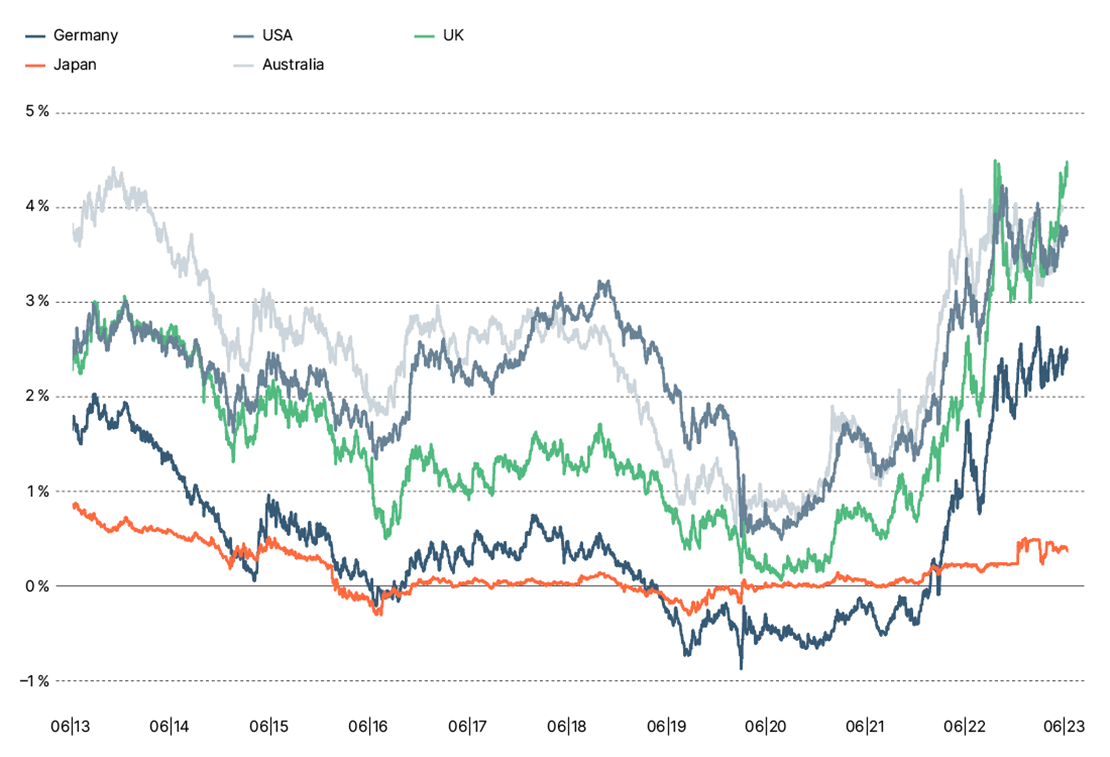

Ten-year yields for global government bonds:

Volatility reflects economic uncertainty

The strategic challenge: highly diverse scenarios

Portfolio managers currently face a major challenge of incorporating inflation forecasts, the corresponding reactions from central banks, and the resulting economic impacts into their own strategic allocation decisions. Asset owners are likely to be influenced by three scenarios:

1) The Goldilocks scenario reloaded. For many, perhaps the standard scenario or the ideal brave new world: inflation would decrease in the medium term and central banks, having already reached the maximum of interest rate hikes, could start lowering interest rates soon again. This might help the economy avoid a recession and a significant downturn in labour markets. This scenario would have a positive effect on investments in almost all asset classes.

2) The moderate risk scenario: Inflation fails to meet the two percent target in the next two years. This would leave central banks with little leeway for rapid interest rate cuts – and possibly trigger an economic slowdown. Equity markets would be negatively affected while bond markets, having potentially already priced in a moderate level of risk, may prove to be a stabilizing factor even in this situation.

3) The extreme risk scenario: Inflation could continue to rise because of second-round effects or further unforeseen inflationary pressures, such as those seen during the war in Ukraine. Central banks would then have to further increase interest rates. A strong negative impact on the economy and employment would be very likely, leading to the dreaded stagflation with potential negative effects for both equities and bonds.

Bonds are staging a fitting comeback

Anyone who needs to prepare their portfolio for various scenarios can now turn to bonds again as a crucial part of the solution. They offer potential for attractive returns and portfolio risk mitigation, especially after central banks have raised interest rates.

“Investors are increasingly cost-conscious in their decision-making processes for allocations. This is reflected in the growth of ETF volumes. However, many of our clients feel that their requirements are not met by the standardized offerings of these products. Rule-based solutions can combine ETF-like cost structures with individual requirements for bond investments,” says Jochen Meyers, summarising several clients’ views on the potential of bond market investments.

Customised solutions, such as those offered by Universal Investment, can be finely tailored to individual specifications. These customized offerings cater to specific requirements, such as focusing on particular countries, currencies, and maturity ranges, or aligning precisely with, an investor's ESG strategy (more on bonds and ESG strategies in the white paper from 2022).

Growing interest in global government bonds

“We’re seeing an increased demand for mandates and mandate inquiries related to global government bond portfolios,” notes Wolfgang Zecha. When selected with appropriate creditworthiness, they can be regarded as a “safe investment” within the portfolio, especially if currency risks against the euro are hedged. Currently, bonds offer higher ongoing yields compared to previous years. Investing in government bonds can boost returns in a “Goldilocks scenario” as well as help stabilise the overall portfolio in a “moderate risk scenario” through declining yields and gains in market value. When combined with interest rate hedging overlays, global bond portfolios can outperform traditional fixed income investments, even in the dreaded stagflation scenario.

Tobias Schoelles, Portfolio Manager, Universal Investment Luxembourg

Tobias Schoelles, Portfolio Manager, Universal Investment Luxembourg

We can provide asset owners with effective support by creating tailored country allocations that enable them to achieve the ideal balance of return, liquidity, rating, and ESG requirements

Alternative: Stay short, wait, and see

Investors who are reluctant to commit and wish to keep all options open given the uncertain scenarios can also tactically invest in short-term bonds. In such mandates, investments would typically be broadly diversified into government and/or corporate bonds. With capital thus parked, one can earn the expected high bond yields in the short-term maturity range over the course of one, two or even three years – and all with extremely low duration and credit risks. This strategy is particularly attractive if analysts are proven right and interest rates remain relatively high at the short end.

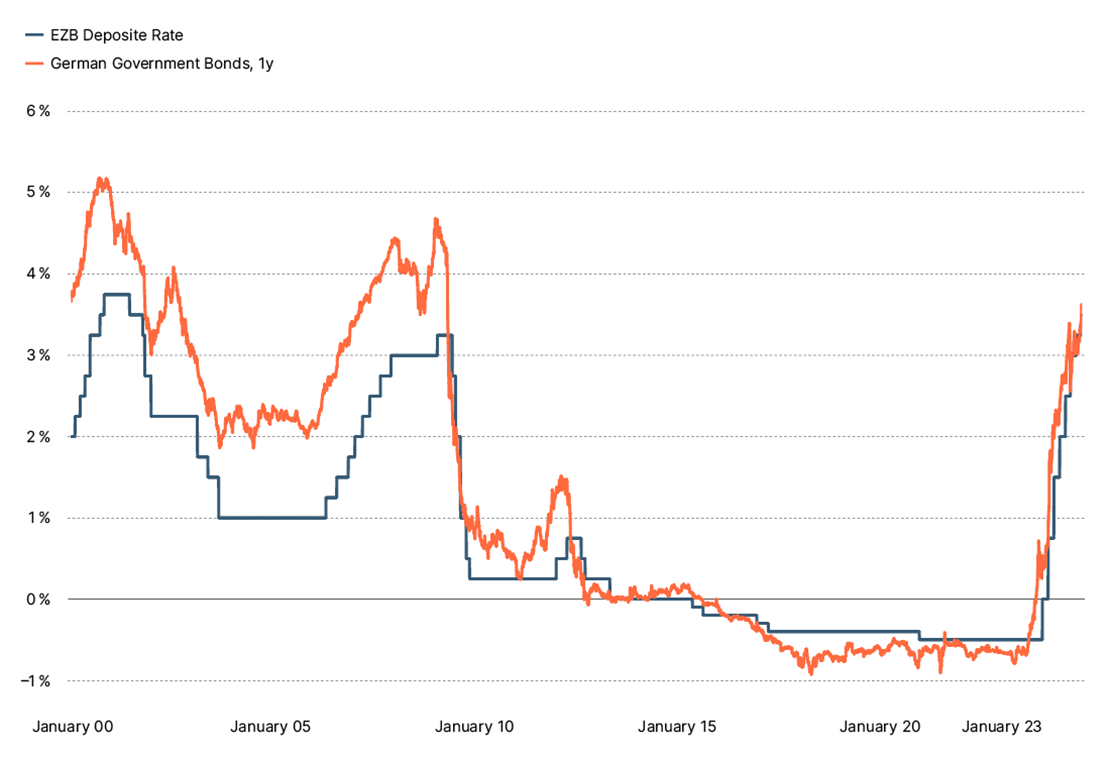

Following ECB interest rate decisions:

Short-term bonds attractive again

Making ongoing adjustments is crucial for a bond portfolio that includes short-term securities. This ensures diversification and continuous monitoring. Trading also plays a significant role as maturing bonds need to be replaced. By bundling large trading volumes, Universal Investment can achieve price and cost advantages and pass them on to clients.

Bonds instead of deposits

Since January 1, 2023, there has been a fundamental change in outsourcing of cash holdings for professional investors. With the elimination of deposit insurance for private banks, the risks of deposits must be re-evaluated, after having been considered as risk-less so far. Liquidity management using Euro Government Bills as an alternative to holding cash can bring significant advantages.

The end of deposit insurance for asset owners has significantly changed the risk parameters of cash outsourcing for many of our clients. Euro Government Bills can prove attractive due to their high liquidity, solid creditworthiness, and great diversification potential

The basis for bills as a cash option lies in their highly liquid market, characterised by an abundance of new issues and taps, facilitating the trading of large clips. Even during the most trying stages of the COVID-19 pandemic, Bills maintained their liquidity, consistently trading at favourable prices – unlike papers from certain other credit sectors. Legally equivalent to government bonds, they offer investors the advantage of flexible liquidity management, facilitating swift establishment and restructuring of positions.

Euro Government Bills

Non-interest-bearing money market instruments offered by the debt agencies of individual euro countries for short-term financing in regular bill actions.

((insert end))

Government Bills also offer dual diversification potential: they reduce exposure to the banking sector compared to deposits, while also reducing overall portfolio exposure to the corporate sector. With many money market funds, a significant corporate exposure often creeps in “through the back door”. Government Bills, on the other hand, increase the proportion of “safe-haven securities” in the portfolio.

Universal Investment has proven its expertise in providing services related to Euro Government Bills for cash holdings over many years. Tobias Schölles explains: “Even in the low-interest rate phase, bills were a sensible alternative to banks that at the time wanted to avoid outsourcing as much as possible. In the current environment of high central bank interest rates, they not only offer all the aforementioned advantages but also provide a highly attractive yield with manageable risk.”