Drucken:

Press Release

Immobilien-Umfrage 2025: Institutionelle Investoren favorisieren Immobilien, aber Infrastruktur gewinnt an Bedeutung

Erscheinungsdatum:

16. September 2025

Frankfurt

- Immobilienanteil soll konstant bleiben

- Bei Neuinvestitionen steht Europa im Fokus

- Büro und Wohnen bleiben wichtigste Nutzungsarten, Logistik holt auf

- Kaufpreise wieder attraktiver, steigende Preise erwartet

- Offener Immobilien-Spezialfonds und Luxemburger S.C.S./S.C.S.p. weiterhin beliebteste Anlagevehikel

- Bei Neuinvestitionen steht Europa im Fokus

- Büro und Wohnen bleiben wichtigste Nutzungsarten, Logistik holt auf

- Kaufpreise wieder attraktiver, steigende Preise erwartet

- Offener Immobilien-Spezialfonds und Luxemburger S.C.S./S.C.S.p. weiterhin beliebteste Anlagevehikel

In seiner vierzehnten, jährlich stattfindenden Immobilien-Umfrage befragte Universal Investment im Juli und August 2025 institutionelle Investoren zu ihrem Anlageverhalten und ihren Markterwartungen. Für die teilnehmenden Pensionseinrichtungen, Versicherungen, Kreditinstitute und Unternehmen aus Deutschland mit einem verwalteten Vermögen von insgesamt rund 69 Milliarden Euro steht fest: Der Immobilienanteil an ihrem Gesamtportfolio soll mit rund 26 Prozent konstant bleiben. Erkennbar sind jedoch ein positiverer Marktausblick und ein deutlicher Trend zu Europa.

Immobilien bleiben klar führend, Infrastruktur etabliert sich langsam

Durch das erhöhte Interesse an alternativen Investments vermischen sich zunehmend Immobilien- und Infrastrukturinvestments in den Portfolios institutioneller Investoren. So sind auch Infrastrukturanlagen bereits in vielen Portfolios institutioneller Investoren vertreten. Bei 62 Prozent der Befragten, die Immobilien- und Infrastrukturinvestitionen kombinieren, dominieren allerdings weiterhin Immobilien. Knapp 14 Prozent haben Immobilien und Infrastruktur etwa gleichgewichtet, während 21 Prozent der Investoren in Immobilien, aber noch nicht in Infrastruktur investiert haben. Der durchschnittliche Anteil von Immobilien im Gesamtportfolio liegt bei 26 Prozent, der von Infrastruktur bei sieben Prozent. Beide Anteile sollen in den kommenden zwölf Monaten unverändert bleiben.Deutschland dominiert, Europa rückt verstärkt in den Fokus

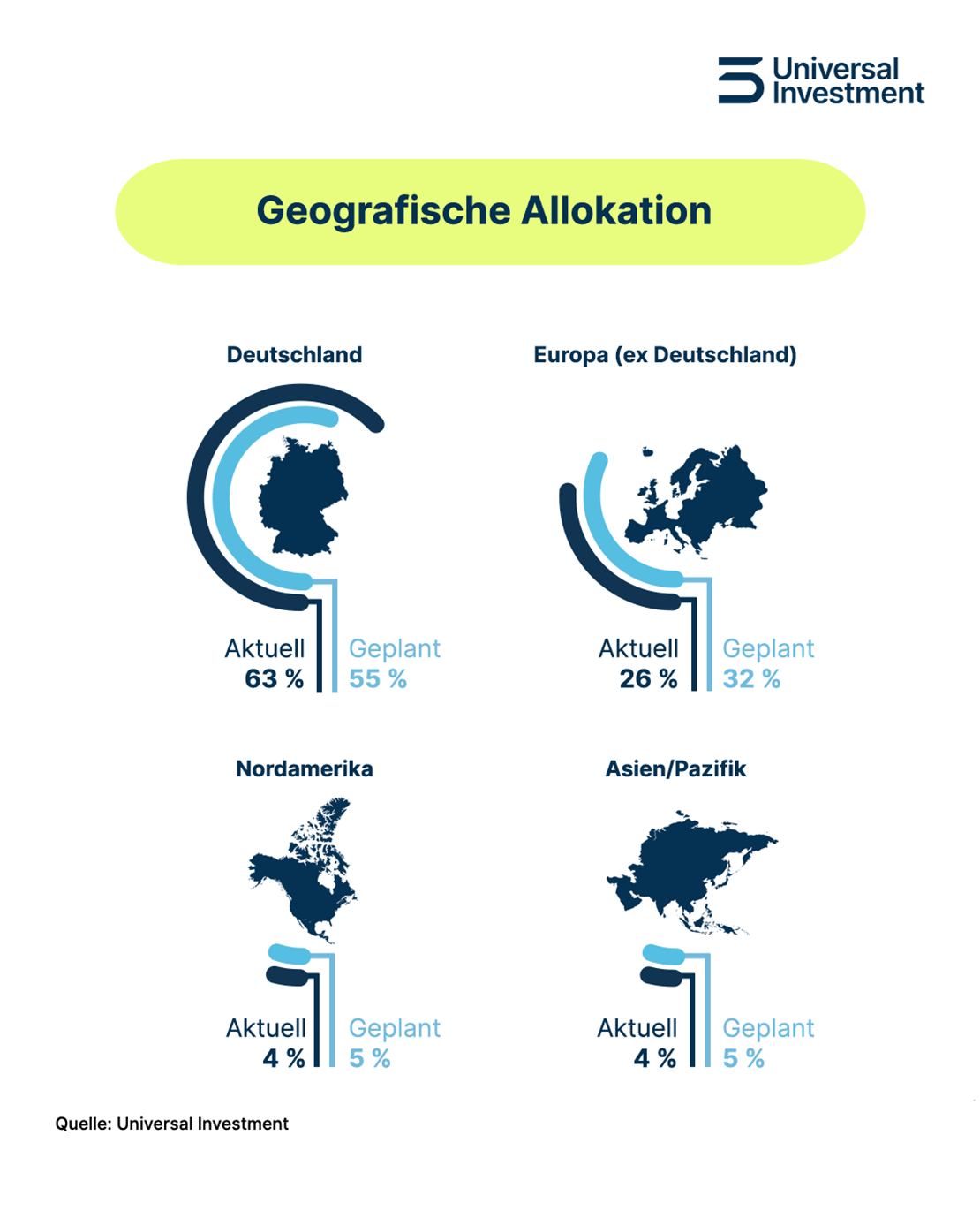

Die derzeitigen Bestandsportfolios der befragten Investoren bestätigen erneut eine Vorliebe für den Heimatmarkt: Aktuell befinden sich 63 Prozent des Immobilienportfolios in Deutschland und 26 Prozent im europäischen Ausland. Der Anteil von Nordamerika und Asien/Pazifik liegt bei jeweils rund vier Prozent.

Bei den Neuinvestitionen liegt der Fokus der Befragten auf Europa mit einem Anteil von insgesamt 87 Prozent. So sollen 32 Prozent der Neuinvestitionen in Europa außerhalb Deutschlands erfolgen, während der Anteil in Deutschland mit 55 Prozent den Homebias abermals unterstreicht. Der Anteil der geplanten Neuinvestitionen in Asien/Pazifik und Nordamerika liegen mit jeweils fünf Prozent leicht über dem aktuellen Immobilienbestand der Umfrageteilnehmer.

„Der Trend zu Europa zeigt, dass institutionelle Investoren nach stabileren Märkten und einer breiteren geografischen Diversifikation in Europa suchen. Grund könnte die Unsicherheit infolge der geopolitischen Entwicklungen der letzten Monate sein“, erklärt Kurt Jovy, Head of Real Estate bei Universal Investment.

Büro bleibt vorn, Logistik holt auf

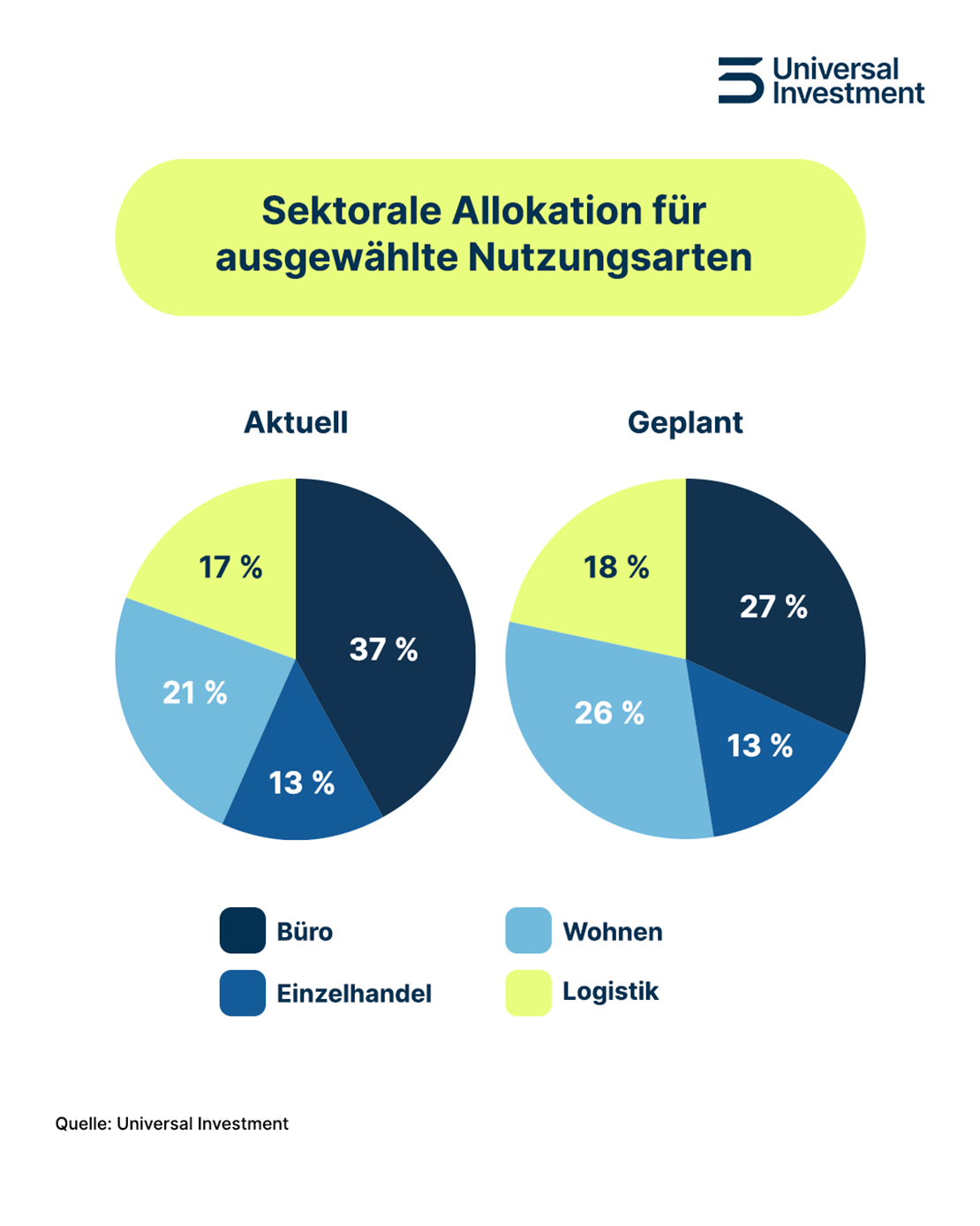

Büroimmobilien bleiben mit knapp 37 Prozent in den Bestandsportfolios weiterhin die führende Nutzungsart, gefolgt von Wohnen (21 Prozent), Logistik (17 Prozent) und Einzelhandel (13 Prozent). Im Vergleich zum Vorjahr haben Logistikimmobilien mit einem Anstieg von vier Prozentpunkten deutlich an Bedeutung gewonnen.

Bei den geplanten Neuinvestitionen zeichnen sich Veränderungen ab: Insbesondere Einzelhandelsimmobilien werden wieder verstärkt gesucht (Anteil 13 Prozent versus sechs Prozent im Vorjahr), während Büroimmobilien in der Gunst der Anleger verloren haben (Anteil 27 Prozent versus 34 Prozent im Vorjahr).

Bei neueren Nutzungsarten können sich die Befragten vor allem ein Investment in Gebäude der öffentlichen Hand, wie etwa Schulen, Kindergärten oder Behörden (41 Prozent), sowie in Rechenzentren (37 Prozent) vorstellen.

Bei den geplanten Neuinvestitionen zeichnen sich Veränderungen ab: Insbesondere Einzelhandelsimmobilien werden wieder verstärkt gesucht (Anteil 13 Prozent versus sechs Prozent im Vorjahr), während Büroimmobilien in der Gunst der Anleger verloren haben (Anteil 27 Prozent versus 34 Prozent im Vorjahr).

Bei neueren Nutzungsarten können sich die Befragten vor allem ein Investment in Gebäude der öffentlichen Hand, wie etwa Schulen, Kindergärten oder Behörden (41 Prozent), sowie in Rechenzentren (37 Prozent) vorstellen.

Immobilienpreise attraktiver, steigende Preisen erwartet

In Bezug auf die Immobilienpreise für Neuinvestitionen aller Nutzungsarten sind sich die Befragten größtenteils einig: Die Einstiegspreise sind mittlerweile deutlich attraktiver. Für Deutschland sehen 38 Prozent der Befragten die Preise als niedrig oder fair an (Vorjahr 18 Prozent) und nur noch 48 Prozent als hoch, aber noch akzeptabel (Vorjahr 65 Prozent). Für das restliche Europa fällt das Urteil noch besser aus. 50 Prozent der Teilnehmer beurteilen die Preise als niedrig oder fair (Vorjahr 29 Prozent) und 50 Prozent als hoch, aber noch akzeptabel (Vorjahr 59 Prozent). Nicht mehr akzeptabel sind die Preise in Deutschland nur für 14 Prozent der Befragten und in Europa sogar für keinen der Umfrageteilnehmer. In Nordamerika werden die Preise mit jeweils 38 Prozent in der Breite entweder als fair oder hoch, aber noch akzeptabel bewertet. Immobilien im asiatisch-pazifischen Raum sind für 75 Prozent und damit für die große Mehrheit der Befragten fair bepreist.

Für das nächste Jahr erwartet die Mehrheit der Umfrageteilnehmer steigende Immobilienpreise, in Deutschland (59 Prozent), in Europa ohne Deutschland (61 Prozent) und Asien/Pazifik (67 Prozent). In Nordamerika ist das Bild gemischt. Während 44 Prozent der Umfrageteilnehmer steigende Preise erwarten, rechnen 56 Prozent mit rückläufigen Preisen. Aktuell liegt die erwartete durchschnittliche Cashflow-Rendite für Neuinvestitionen bei 4,7 Prozent, was einen deutlichen Anstieg gegenüber dem Vorjahr (4,1 Prozent) darstellt. Gleichzeitig erwarten 27 Prozent der Investoren für 2026 in guten Lagen der Top-7-Städte in Deutschland Nettoanfangsrenditen zwischen 3,0 und 3,5 Prozent. Jeweils 36 Prozent der Befragten rechnen für das kommende Jahr mit Nettoanfangsrenditen zwischen 3,5 und 4,0 Prozent beziehungsweise über 4,0 Prozent.

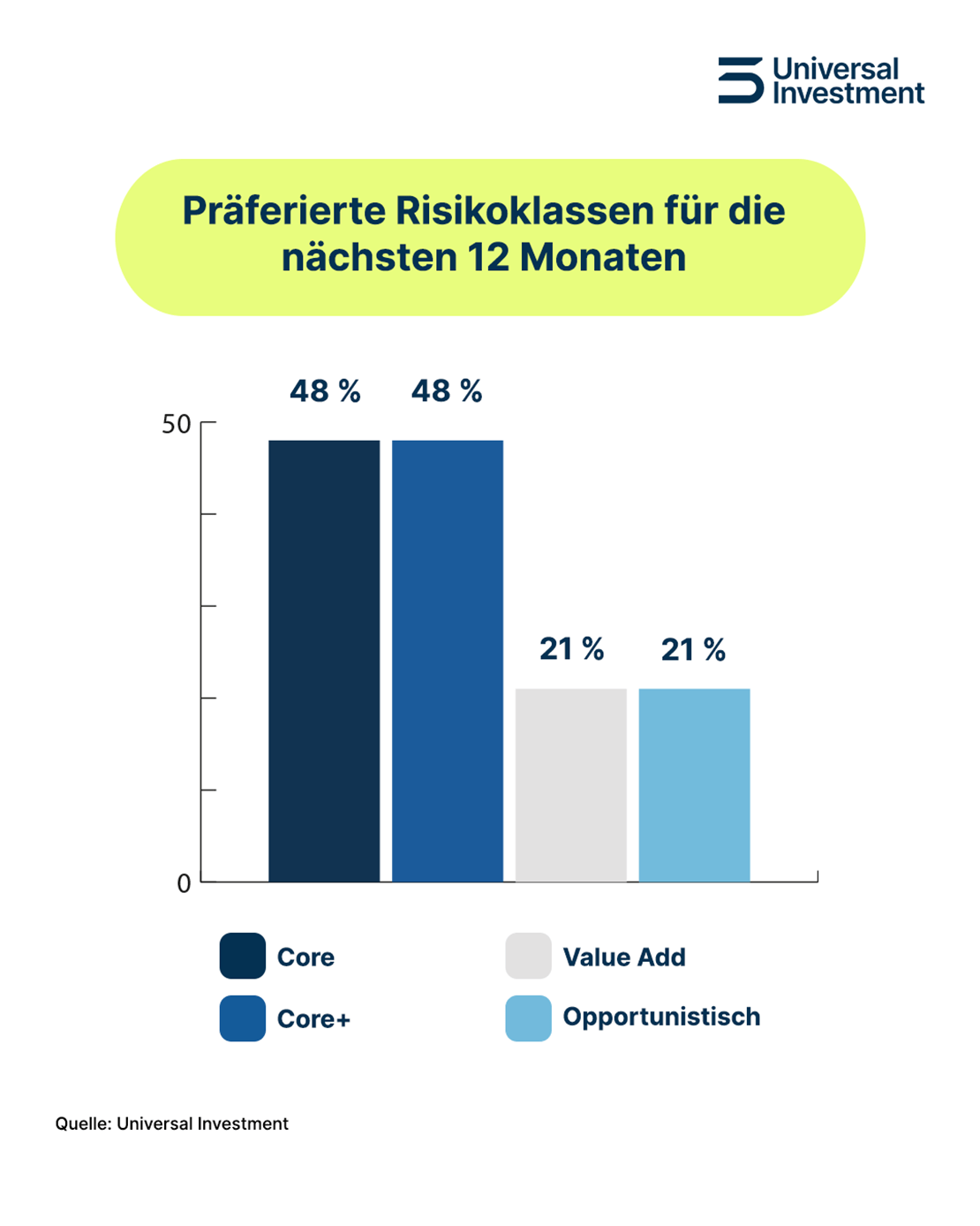

Bei den Risikoklassen dominieren weiterhin Core und Core+ mit jeweils 48 Prozent. Das zeigt, dass Sicherheit nach wie vor höchste Priorität hat. Andererseits scheinen Investoren wieder bereit, etwas mehr Risiken einzugehen. Zumindest ist der Anteil an Value-Add und opportunistischen Strategien deutlich gestiegen und liegt jetzt bei jeweils 21 Prozent.

„Wir erwarten, dass sich die Transaktionsmärkte daher wieder schrittweise beleben, auch wenn sich viele Investoren noch auf die Optimierung ihres Immobilienportfolios konzentrieren“, kommentiert Jovy die Ergebnisse.

Bei den Risikoklassen dominieren weiterhin Core und Core+ mit jeweils 48 Prozent. Das zeigt, dass Sicherheit nach wie vor höchste Priorität hat. Andererseits scheinen Investoren wieder bereit, etwas mehr Risiken einzugehen. Zumindest ist der Anteil an Value-Add und opportunistischen Strategien deutlich gestiegen und liegt jetzt bei jeweils 21 Prozent.

„Wir erwarten, dass sich die Transaktionsmärkte daher wieder schrittweise beleben, auch wenn sich viele Investoren noch auf die Optimierung ihres Immobilienportfolios konzentrieren“, kommentiert Jovy die Ergebnisse.

ESG und künstliche Intelligenz sind und bleiben Schlüsselthemen

ESG bleibt nach wie vor ein zentrales Thema für institutionelle Investoren. Rund 72 Prozent der Befragten räumen ESG bei ihren Immobilienanlagen weiterhin höchste Priorität ein. Künstliche Intelligenz wird zwar von 90 Prozent der Umfrageteilnehmer als wichtig erachtet, nur jeweils 30 Prozent nutzen sie jedoch bereits oder planen sie für unterschiedliche Arbeitsbereiche zu nutzen. Die verbleibenden 30 Prozent wollen erst noch die weitere Entwicklung abwarten.Dienstleistungen von Service-/Master-KVGen werden überwiegend genutzt

42 Prozent der Investoren nehmen für ihre Fonds das komplette Servicepaket einer oder mehrerer Service-/Master-KVGs in Anspruch, immerhin 29 Prozent lagern zumindest einzelne Middle-/Back-Office-Tätigkeiten wie Fondsbuchhaltung oder Reporting an eine Service-KVG aus.Offene Immobilien Spezial-AIF und Luxemburger S.C.S/S.C.S.p. präferierte Anlagevehikel

Beliebtestes Vehikel bei der Neuauflage von Fonds sind der deutsche offene inländische Spezial-AIF mit festen Anlagebedingungen und Anlageschwerpunkt Immobilien sowie der Luxemburger SICAV, RAIF oder SIF als S.C.S /S.C.S.p. Jeweils die Hälfte der Befragten spricht sich für diese beiden Vehikel aus. Bei Luxemburger Vehikeln interessieren sich die die Investoren zudem noch für den FCP (39 Prozent) sowie die SICAV, RAIF oder SIF als S.A. (43 Prozent). An ELTIFs besteht hingegen auch nach der überarbeiteten Regulierung zumindest für Immobilienanlagen noch kein Interesse. Sogenannte Miteigentumsfonds – dabei bringt ein Investor seine Bestandsimmobilien ohne Verlust seiner Eigentümerstellung und damit im Einzelfall grunderwerbssteuerneutral in einen Fonds ein – sind hingegen für etwa ein Drittel der Befragten interessant. „Ein spannendes Anlagevehikel mit einigen Vorteilen für Investoren“, sagt Jovy dazu abschließend.Pressekontakt

Suvi Wentland

Head of External Communications

Alfons Niederländer

Senior Communications ManagerDisclaimer

Stand: August 2025

©2025. Alle Rechte vorbehalten. Diese Publikation richtet sich ausschließlich an professionelle oder semiprofessionelle Investoren und ist nicht zur Weitergabe an Privatanleger bestimmt. Die Publikation dient ausschließlich Marketingzwecken. Die zur Verfügung gestellten Informationen bedeuten keine Empfehlung oder Beratung. Alle Aussagen geben die aktuelle Einschätzung des Verfassers wieder. Universal Investment übernimmt keinerlei Haftung für die Verwendung dieser Publikation oder deren Inhalts. Vervielfältigungen, Weitergaben oder Veränderungen dieser Veröffentlichung oder deren Inhalts bedürfen der vorherigen ausdrücklichen Erlaubnis von Universal Investment.

©2025. Alle Rechte vorbehalten. Diese Publikation richtet sich ausschließlich an professionelle oder semiprofessionelle Investoren und ist nicht zur Weitergabe an Privatanleger bestimmt. Die Publikation dient ausschließlich Marketingzwecken. Die zur Verfügung gestellten Informationen bedeuten keine Empfehlung oder Beratung. Alle Aussagen geben die aktuelle Einschätzung des Verfassers wieder. Universal Investment übernimmt keinerlei Haftung für die Verwendung dieser Publikation oder deren Inhalts. Vervielfältigungen, Weitergaben oder Veränderungen dieser Veröffentlichung oder deren Inhalts bedürfen der vorherigen ausdrücklichen Erlaubnis von Universal Investment.